VAT rules for small enterprises

This 2025, the special VAT regime benefiting SMEs comes into effect

Publicado por AdmonVlc

martes, 17 de diciembre de 2024 a las 11:37

Starting January 1, 2025, the special VAT regime (SME regime) allows small businesses to:

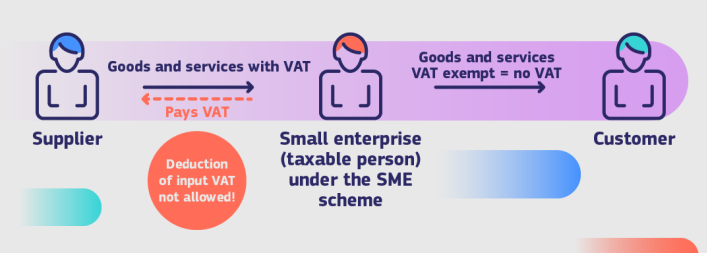

- Sell goods and services without charging VAT to their customers (VAT exemption), and

- Ease their VAT compliance obligations.

Small businesses opting for the VAT exemption will lose the right to deduct VAT on goods and services used to make exempt supplies.

Who can benefit?

Any small business with an annual total turnover not exceeding €100,000 (or its equivalent in national currency) in all Member States during the current and previous calendar years may benefit from the VAT exemption in its Member State of Establishment (MSEST) and/or in other Member States under the cross-border SME scheme.

This only applies if the respective Member State has implemented the regime in its national legislation.

The SME regime is optional.

Non-EU small businesses cannot benefit from the SME regime. In this context, small businesses established in the UK, including Northern Ireland, are considered non-EU small businesses.

Features and updates

- New maximum for the national annual threshold: The maximum annual threshold set by Member States, below which small businesses can exempt their supplies of goods and services from VAT under the SME regime (national and cross-border), is €85,000.

- Cross-border application: Small businesses established in a Member State other than the one where VAT is due can exempt their (cross-border) supplies from VAT, just as small businesses established in that Member State can for domestic transactions.

- Union-wide annual threshold: Small businesses with an annual total turnover across the 27 Member States not exceeding €100,000 can apply the cross-border SME regime.

Simplified compliance

- Single registration: Small businesses will only need to register once for the SME regime in their MSEST. The MSEST will issue a single identification number ("EX number") to be used in all Member States where the small business benefits from the VAT exemption.

- Single quarterly report: Periodic VAT returns are replaced by a single quarterly report to declare the turnover of small businesses across all Member States.

- Simplified invoices

For detailed information, as well as the law's requirements and exceptions, please refer to this link.

Fuente original del contenido:

European Commision

https://sme-vat-rules.ec.europa.eu/index_en?pk_source=linkedin&pk_medium=social&pk_campaign=video_views&pk_keyword=es

17/12/2024 11:37 | AdmonVlc